Bookkeeping is essential for every business, big or small. It helps track income and expenses.

Keeping accurate financial records is crucial for making informed decisions. Bookkeeping involves recording daily transactions, balancing accounts, and preparing financial statements. It may seem tedious, but it ensures financial health and compliance with laws. Proper bookkeeping can highlight profit trends, show where money is going, and prevent financial missteps.

Whether you are a business owner or an aspiring bookkeeper, understanding these basics is key. This guide will introduce you to the essentials of bookkeeping. It will help you keep your finances in order and your business on track. Ready to dive in? Let’s get started!

Credit: www.freshbooks.com

Introduction To Bookkeeping

Bookkeeping is the backbone of any business, ensuring that all financial transactions are recorded accurately. Without it, you might find yourself lost in a sea of receipts and invoices. Understanding the basics of bookkeeping can save you from financial chaos and help your business thrive.

Importance For Small Businesses

Small businesses often operate on tight budgets. Proper bookkeeping helps you keep track of every dollar that comes in and goes out. This clarity can make or break your business.

Imagine having to explain your financial health to an investor without precise records. Accurate bookkeeping can make these conversations straightforward and stress-free. Plus, it helps you identify unnecessary expenses and potential areas for growth.

From tax preparation to financial forecasting, bookkeeping is essential. It’s not just about compliance; it’s about making informed decisions for your business’s future.

Common Bookkeeping Terms

Understanding bookkeeping starts with familiarizing yourself with common terms. Here are a few essential ones:

Assets: What your business owns, like cash, inventory, and equipment.

Liabilities: What your business owes, such as loans or mortgages.

Equity: The owner’s stake in the business after liabilities are subtracted from assets.

Revenue: Income generated from business activities.

Expenses: Costs incurred in the process of earning revenue.

These terms are the foundation of your financial statements. Knowing them helps you understand your business’s financial health at a glance.

When you see terms like “accounts receivable” or “accounts payable,” you should know they refer to the money owed to you and the money you owe, respectively.

Next time you sit down with your financial statements, you’ll feel more confident. You’ll know what each term means and why it matters.

So, how well do you know your business’s financial health? Can you confidently navigate your financial statements? Understanding these basics will set you on the path to better financial management.

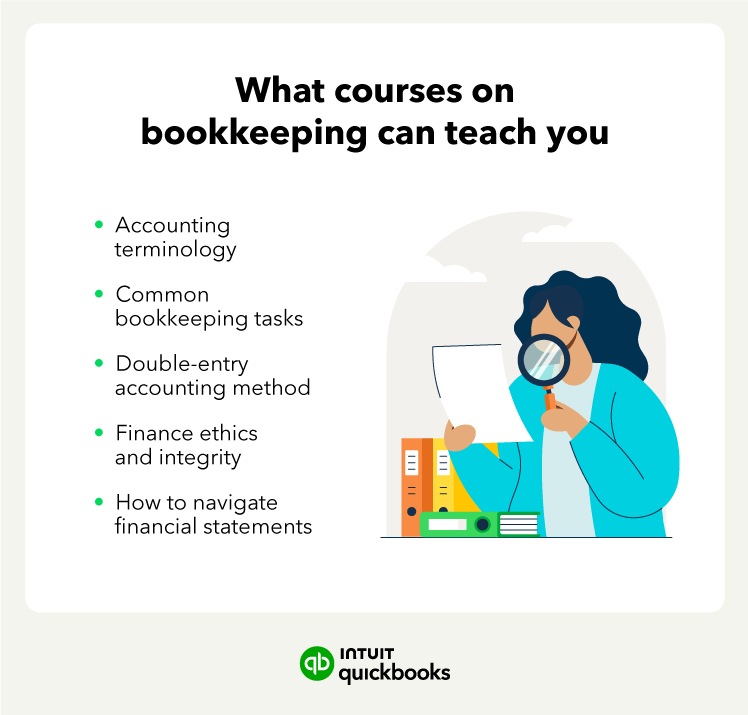

Credit: quickbooks.intuit.com

Setting Up Your Bookkeeping System

Setting up your bookkeeping system is essential for business success. A good system helps track income, expenses, and financial health. It ensures accurate records for tax purposes and helps with financial planning.

Choosing The Right Software

Choosing the right software is key for effective bookkeeping. Software should be user-friendly and fit your business needs. Look for features like invoicing, expense tracking, and financial reporting. Popular options include QuickBooks, Xero, and FreshBooks. Many offer free trials. Take advantage of them to see what works best.

Manual Vs. Automated Systems

Manual systems involve using spreadsheets or paper ledgers. They are simple and low-cost. But they can be time-consuming and prone to errors. Automated systems use software to streamline tasks. They reduce errors and save time. Automated systems can sync with bank accounts and track expenses automatically. They are ideal for growing businesses.

Tracking Income And Expenses

Tracking income and expenses is crucial for any business. It helps you understand your financial health. You can make better decisions. Accurate records ensure you stay on top of your finances. This section will cover how to track income and categorize expenses.

Recording Sales

Recording sales is the first step. Always note every sale. Use a reliable system. This could be software or a simple spreadsheet. Record the date, amount, and customer name. Keep all receipts and invoices. Accurate sales records help in understanding revenue patterns. They also help in forecasting future sales.

Categorizing Expenses

Expenses should be categorized for clarity. This helps in tracking where money goes. Common categories include rent, utilities, and supplies. You can use accounting software. Or, you can use a manual system. Always keep receipts and bills. This practice ensures transparency. It also helps in tax preparation. Proper categorization can reveal areas to cut costs. This can improve your bottom line.

Managing Accounts Receivable And Payable

Efficient bookkeeping involves managing accounts receivable and payable accurately. Keeping track of incoming and outgoing payments ensures financial stability. This process helps businesses maintain clear records and avoid cash flow issues.

Bookkeeping is the backbone of any successful business. Efficiently managing accounts receivable and payable ensures a steady cash flow and keeps your business operations running smoothly. Let’s dive into some practical tips for handling these essential tasks.

Invoicing Clients

Creating and sending invoices is more than just a formality. It’s crucial for getting paid on time. Use clear, detailed invoices to avoid confusion and disputes. Include the services provided, payment terms, and due dates. Consider using invoicing software to streamline the process. This can automate reminders, track payments, and reduce manual errors. Always follow up on overdue invoices. A friendly reminder can prompt timely payments and maintain good client relationships.

Handling Supplier Payments

Paying your suppliers promptly is just as important. It helps you maintain good relationships and avoid late fees. Keep track of due dates and payment terms to stay organized. You might want to use accounting software to manage supplier payments. This ensures accuracy and saves time. Negotiate favorable terms with your suppliers. Sometimes, you can secure discounts for early payments or flexible payment schedules. Managing accounts receivable and payable is a balancing act. How do you ensure your clients pay on time while keeping your suppliers happy? Share your experiences and tips in the comments below!

Reconciling Bank Statements

Reconciling bank statements is a crucial part of bookkeeping. It helps ensure your financial records are accurate. This process involves comparing your internal records with the bank’s statement. It helps catch any errors or discrepancies in your accounts.

Monthly Reconciliation

Performing a monthly reconciliation keeps your records up-to-date. It involves checking each transaction. This ensures every entry in your ledger matches the bank statement. Regular reconciliation prevents long-term errors. It also helps maintain financial health.

Identifying Discrepancies

During reconciliation, you may find discrepancies. These could be due to data entry mistakes or bank errors. Identifying discrepancies early can save you trouble later. It allows for prompt correction and keeps your books accurate. Always double-check suspicious entries for errors.

Credit: quickbooks.intuit.com

Preparing Financial Statements

Preparing financial statements is a critical aspect of bookkeeping that ensures your business remains financially healthy and transparent. These statements provide a clear picture of your company’s financial position, performance, and cash flow. Let’s dive into the key components: balance sheets and income statements.

Balance Sheets

The balance sheet is a snapshot of your company’s financial condition at a specific point in time. It consists of assets, liabilities, and equity. You can think of it as a summary of what your business owns and owes.

Assets include things like cash, inventory, and equipment. Liabilities are what your business owes, such as loans and accounts payable. Equity is the owner’s stake in the company.

To create a balance sheet, list out all your assets and liabilities. Then, calculate the equity by subtracting liabilities from assets. This helps you understand your company’s net worth.

Income Statements

An income statement shows your business’s profitability over a specific period, usually a month, quarter, or year. It details revenues and expenses, ultimately revealing your net income or loss.

Start by listing all sources of revenue, such as sales and service income. Then, subtract expenses like salaries, rent, and utilities. This gives you your net income.

Income statements are crucial for assessing your business’s performance. Are you making money or losing it? This insight helps you make informed decisions about future operations.

Have you ever wondered if your business is on the right track financially? Preparing financial statements can give you the answers. By regularly updating balance sheets and income statements, you stay informed and ready to tackle any financial challenges.

Tax Preparation Tips

Tax season can be a daunting time for many, especially when it comes to preparing your documents and ensuring everything is in order. However, with some simple and practical tips, you can make tax preparation a much smoother process. Let’s delve into some effective bookkeeping strategies to help you get started.

Organizing Receipts

One of the most critical aspects of tax preparation is organizing your receipts. Receipts serve as proof of your expenses and are essential for claiming deductions. Keep a dedicated folder or a digital system to store all your receipts throughout the year.

Consider using apps that allow you to scan and categorize receipts instantly. This way, you won’t have to sift through piles of paper at the last minute. Label each receipt with the date and type of expense to make retrieval easier when needed.

Have you ever faced a situation where you couldn’t find an important receipt? By staying organized, you can avoid this stress and ensure you have all necessary documents at your fingertips.

Understanding Deductions

Understanding what deductions you are eligible for can significantly impact your tax return. Deductions reduce your taxable income, so knowing the right ones can save you money. Common deductions include business expenses, home office costs, and charitable donations.

Consult with a tax professional or use reliable online resources to educate yourself about potential deductions. Keep detailed records of all deductible expenses to support your claims. For instance, if you work from home, track your utility bills and other related costs.

Are you taking full advantage of all possible deductions? Being proactive about understanding and tracking them can lead to substantial savings on your taxes.

By implementing these simple yet effective tips, you can navigate tax season with greater ease and confidence. Start organizing your receipts and understanding your deductions today to ensure a stress-free tax preparation experience.

Hiring A Professional Bookkeeper

Bookkeeping plays a crucial role in the success of any business. Keeping track of your finances can be overwhelming. Hiring a professional bookkeeper can provide relief and ensure accuracy. A bookkeeper manages your financial records, ensuring your business runs smoothly. This service can save you time and prevent costly mistakes.

When To Consider

Consider hiring a bookkeeper when your business starts growing. Managing finances becomes complex as transactions increase. A bookkeeper can handle this complexity. If you find yourself spending too much time on financial tasks, it may be time to hire help. This allows you to focus on other important aspects of your business.

Finding The Right Fit

Finding the right bookkeeper involves considering several factors. Look for someone with experience in your industry. Check their qualifications and ask for references. Communication is key. Ensure they can explain financial terms in a way you understand. This will help you make informed decisions. Trust is also essential. You need to feel confident that they will handle your finances responsibly.

Frequently Asked Questions

What Exactly Does A Bookkeeper Do?

A bookkeeper records financial transactions, maintains accurate ledgers, reconciles bank statements, and produces financial reports. They ensure financial data is up-to-date and organized.

What Is A Bookkeeper Hourly Rate?

A bookkeeper’s hourly rate typically ranges from $20 to $50. Rates vary based on experience and location.

What Qualifications Do I Need To Be A Bookkeeper?

To be a bookkeeper, you need a high school diploma and proficiency in accounting software. Certification can enhance job prospects.

Is Bookkeeping Good Money?

Yes, bookkeeping can be a profitable career. Experienced bookkeepers often earn competitive salaries. Demand for skilled bookkeepers remains high.

Conclusion

Bookkeeping is vital for every business. It keeps your finances organized. This helps in making smart decisions. Accurate records prevent costly mistakes. Regular bookkeeping saves time and stress. It ensures you comply with tax laws. Invest in good bookkeeping practices.

Your business will thank you.